Question of the Day: How Much Would I Need To Save Monthly To Have $1 Million When I Retire?

One idea I make clear to my students is that they will need to understand investing since in this new era, they will be responsible for their own retirement. A dwindling number of companies offer their employees a pension plan which will continue to pay them in retirement. I also like this question because it demonstrates the power of compound interest and consistently adding to your investments.

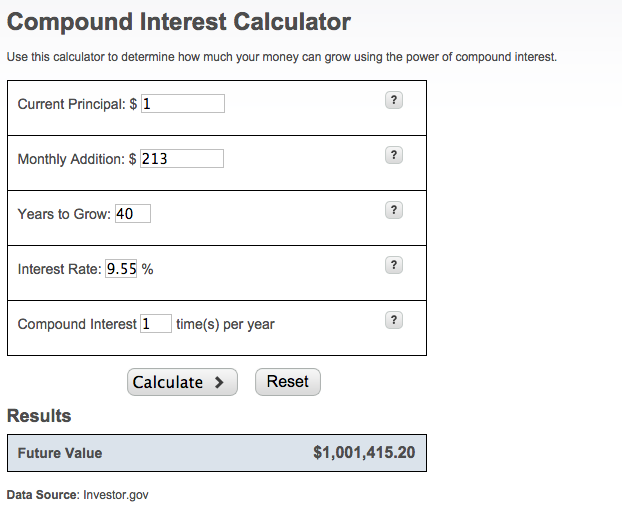

So, first have students estimate how much they need to save monthly over a 40 year period to have a future value of $1 million at the end of the period. Tell them to assume their stock market investments earn a return of 9.55% (which is the geometric average from 1928-2013 for the S&P500, according to data compiled by NYU) and that the amount they contribute every month remains constant.

Once they have each written down their guesses, you can project this investment calculator on the screen. You might start by putting some of your student guesses into the calculator before arriving at the correct number of $213:

To show the power of compound interest, you can ask the students how much they needed to contribute in order to create this future value over $1,000,000. Multiplying 480 payments by $213 equals $102,240. So in this case, the impact of compounding has almost a 10X multiplier effect: $102,240 was contributed to create a final future value over $1,000,000.

Two other points to extend this lesson:

- Demonstrate how sensitive the future value is to a change in investment return. There are no guarantees that the future returns of the stock market will equal the past. If you chose a more conservative return figure of 6%, that stream of monthly contributions of $213 for 480 months would only yield a future value of about $396,000. Important to highlight to students you cannot control the return you will get from the stock market, but you can control how much you save so be sure to have a buffer of safety by saving more.

- Don’t expect that $1,000,000 in future value to have the same purchasing power as $1,000,000 today due to inflation. In fact, assuming 3% inflation over the 40 year period means that $1,000,000 would be worth about $307,000 in today’s dollars (present value calculator here).

Here are some great follow-up questions to ask your students about this resource:

- How does $213/month over 40 years (which is a total of $102,240) become over $1 million? (Hint: think about compounding)

- Because of inflation, the purchasing power of $1 million today is more than it will be 40 years from now. While you cannot control how much return you will earn on your investments, what are some things you can do to increase the amount of money you have over this time period?

- Do you think that you will invest at least $213/month? Less? More? Why or why not?

- Now that you have seen the power of compounding, when would you recommend someone start investing?

Want this resource and questions in slide format to use in class? Click here!

![]()

About the Author

Tim Ranzetta

Tim's saving habits started at seven when a neighbor with a broken hip gave him a dog walking job. Her recovery, which took almost a year, resulted in Tim getting to know the bank tellers quite well (and accumulating a savings account balance of over $300!). His recent entrepreneurial adventures have included driving a shredding truck, analyzing executive compensation packages for Fortune 500 companies and helping families make better college financing decisions. After volunteering in 2010 to create and teach a personal finance program at Eastside College Prep in East Palo Alto, Tim saw firsthand the impact of an engaging and activity-based curriculum, which inspired him to start a new non-profit, Next Gen Personal Finance.

SEARCH FOR CONTENT

Subscribe to the blog

Get Question of the Day, FinCap Friday, and the latest updates from NGPF in your inbox by subscribing today:

MOST POPULAR POSTS