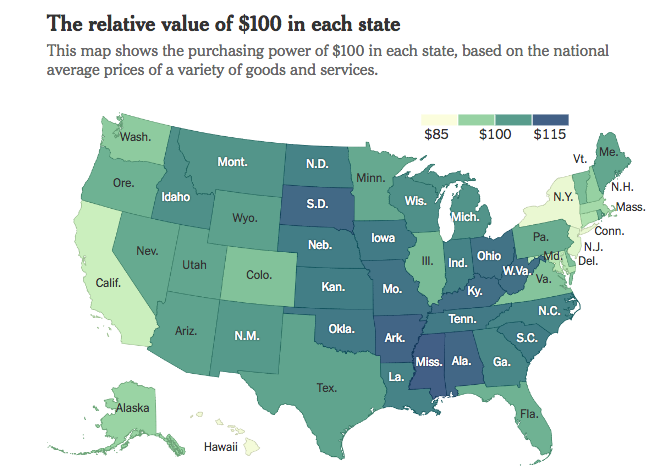

Question: How Does the Cost of Living Vary By State?

Courtesy of NY Times (from Bureau of Economic Analysis):

Purchasing power (a.k.a. cost of living) becomes a critical consideration for students considering where they would like to live or even go to college. $100 will buy you a lot less if you attend college or live in New York City vs. rural Maine. This national map shows how purchasing power varies by state.

How to read this chart (from NY Times):

To better understand, imagine a store offering a range of goods and services, each for sale at the national-average price for that particular item. Now, imagine a shopping cart filled with $100 worth of items from that store. In Hawaii, $100 buys about 85 percent of the goods in the cart thanks to the high prices there. In other words, $100 in Hawaii feels more like $85.60, compared to the national average. In Mississippi, the opposite is true. With $100, you would be able to buy the cart’s contents and more: the equivalent of $115.30 of goods and services from the national-average store.

What data is used in this analysis (from NY Times)?

The Regional Price Parities are calculated using data already collected for another indicator, the Consumer Price Index, which serves as a measure of inflation. For that index, the government tracks prices of more than 200 goods and services, including men’s suits, college textbooks, cereal, electricity and cars and trucks. It also tallies rents, which are particularly variable among states. The “real value” of $100 in rent can range from roughly $63 in Hawaii to $160 in Arkansas.

Questions for your students:

- Of the major costs of a typical family, which do you think differ most by geography and account for these purchasing power differences? (e.g. home prices/rents much higher in certain states (California, New York) compared to others (Mississippi))

- How does your state stack up compared to the national average when it comes to purchasing power? Are you aware of any cost categories in your state (or town/city) which are extremely high or low compared to national averages?

- Will cost of living impact how you think about where you want to live and work in the future?

- Do you think that incomes and purchasing power are related? Are companies required to pay their employees more to compensate for higher costs of living?

Want this resource and questions in slide format to use in class? Click here!

________

Check out this NGPF Activity: Select A City To Live In

About the Author

Tim Ranzetta

Tim's saving habits started at seven when a neighbor with a broken hip gave him a dog walking job. Her recovery, which took almost a year, resulted in Tim getting to know the bank tellers quite well (and accumulating a savings account balance of over $300!). His recent entrepreneurial adventures have included driving a shredding truck, analyzing executive compensation packages for Fortune 500 companies and helping families make better college financing decisions. After volunteering in 2010 to create and teach a personal finance program at Eastside College Prep in East Palo Alto, Tim saw firsthand the impact of an engaging and activity-based curriculum, which inspired him to start a new non-profit, Next Gen Personal Finance.

SEARCH FOR CONTENT

Subscribe to the blog

Get Question of the Day, FinCap Friday, and the latest updates from NGPF in your inbox by subscribing today:

MOST POPULAR POSTS