Reading List for June 26-28

Current Events-Stimulus Checks

- QOD: What are most people spending their stimulus checks on? Answer: Household expenses. According to a Census Bureau Household Pulse survey, 85.5% answered this way. Of those earning between $75,000and $99,000 who got a prorated check, checks were more likely be used to pay down debt or saved.

- If you have a family member in a nursing home, you might want to be sure the nursing home didn’t try to pocket your loved one’s check. (WAPO-1).

- The government sent $1.4 billion in stimulus checks to dead people. How can this happen? The IRS has access to SSA death data, but the Treasury, which issued the checks, did not. (Forbes).

Economics

- Between PPP loans, stimulus checks, and a record 33% savings rate in April, bank deposits jumped $2 trillion (yes, trillion) since January. (CNBC)

- This week’s new unemployment claims were 1.48 million, higher than predicted. The previous week’s figure was revised up to 1.54 million. This figure has exceeded 1 million for 12 straight weeks. However, the continuing claims figure dropped slightly from 20.29 million to 19.52 million. (Yahoo Finance)

- The Economist describes state budgets in the US as a result of this pandemic as a "train wreck."

- This NYT Opinion piece contains compelling data analysis of the racial opportunity gaps in the US.

- The Commerce Department confirmed that GDP did, in fact, drop 5% for the first quarter (through March, just a few weeks into the pandemic). This is the largest drop since the 8.4% drop during the first quarter of the Great Recession, and the worst is yet to come. (Yahoo)

- This NPR Planet Money podcast is helpful in explaining why reopening won’t be enough to “save the economy.”

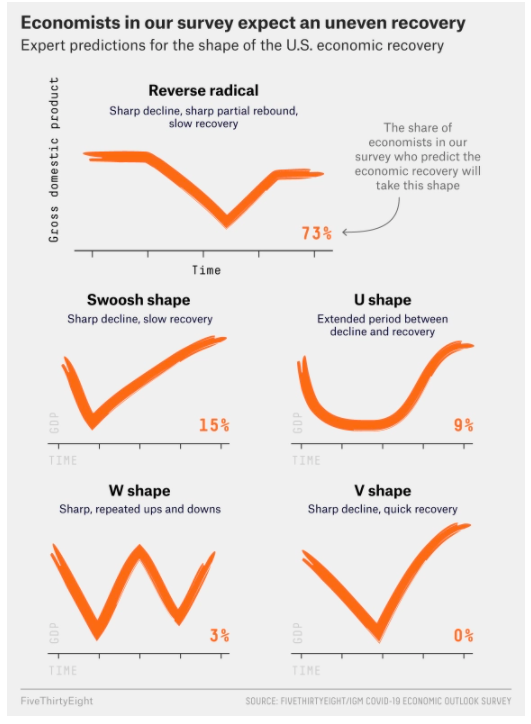

- What will the economic recovery look like? 538 polled economists and here are the results:

Investing

- Looks like the market may finally be starting to reflect concern about the pandemic and economy as the market looks like it will continue trending lower as of publication. (MarketWatch)

- In other market news this week, the indices began to diverge earlier this week, as the outlook for tech stocks looked relatively stronger than blue-chip stocks. (WSJ-subscription).

Higher Education/Student Loans

- Cleveland.com’s Rich Exner has some great suggestions for those with Federal Student Loans to step back and look at how they might use any benefit they may be getting from the CARES Act.

- A shift in policy makes it harder for colleges to increase financial aid for students whose economic situation has changed as a result of the coronavirus. (NPR)

- What will the application process look like next year? Without standardized tests, jobs, and the usual extracurriculars, what should rising seniors be focusing on this summer and next year? (NYT)

Careers

- So what does the job landscape look like as graduates and the millions of unemployed look for work in a pandemic? GOBankingRates has the answer. Contact tracing may be an obvious option, but other industries are looking too.

Health

- There are promising lessons to be learned from the day care centers that remained open during the pandemic. Will schools be able to use this to support reopening? (NPR)

About the Author

SEARCH FOR CONTENT

Subscribe to the blog

Get Question of the Day, FinCap Friday, and the latest updates from NGPF in your inbox by subscribing today:

MOST POPULAR POSTS