QoD: How many years has the typical American homeowner been in their current home?

This is a good one for Economics class as it's a demonstration of supply/demand factors in the housing market. Given that the trend has been for homeowners to stay in their houses for longer periods of time, the supply of houses for sale (inventory) goes down and if new construction doesn't close that supply gap then there's a supply/demand imbalance. You can guess what happens next.

Answer: 13 years

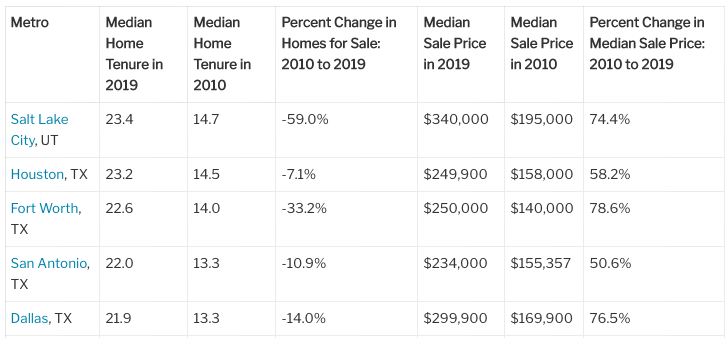

Here's a chart showing the regions where homeowners have been in their homes the longest, the change in homes for sale and the impact on housing prices:

Questions:

- How long have you/your family currently been living in your home/apartment?

- Why do you think that people are staying in their homes longer and not moving?

- Skimming this article can be helpful in coming up with reasons

- The research shows the families average tenure in their homes has risen 5 years since 2010.

- What impact has this had on homes for sale?

- Sale prices for existing homes?

- Use the chart on previous page (above) as evidence.

Here's the ready-to-go slides for this Question of the Day that you can use in your classroom.

Behind the numbers (Redfin)

The typical American homeowner in 2019 had spent 13 years in their home, up from eight years in 2010. Median home tenure increased in all of the 55 metros Redfin analyzed. In Salt Lake City, Houston, Fort Worth, San Antonio, and Dallas homeowners have been in their homes the longest, with typical homeowners in those metros staying in their homes over eight years longer than they did in 2010. In many metros that has led to fewer homes available for first-time homebuyers.

-------------------

How does the cost of a home mortgage vary based on credit scores? Have your students complete this NGPF activity, Calculate: Impact of Credit Scores on Loans and find out.

About the Author

Tim Ranzetta

Tim's saving habits started at seven when a neighbor with a broken hip gave him a dog walking job. Her recovery, which took almost a year, resulted in Tim getting to know the bank tellers quite well (and accumulating a savings account balance of over $300!). His recent entrepreneurial adventures have included driving a shredding truck, analyzing executive compensation packages for Fortune 500 companies and helping families make better college financing decisions. After volunteering in 2010 to create and teach a personal finance program at Eastside College Prep in East Palo Alto, Tim saw firsthand the impact of an engaging and activity-based curriculum, which inspired him to start a new non-profit, Next Gen Personal Finance.

SEARCH FOR CONTENT

Subscribe to the blog

Get Question of the Day, FinCap Friday, and the latest updates from NGPF in your inbox by subscribing today:

MOST POPULAR POSTS