Interactive Monday: The 50/30/20 Budgeting Rule of Thumb in Action

I can't remember how I found this site but thought it might be engaging to your students because it takes a budgeting principle and allows students to see how it actually applies in their community.

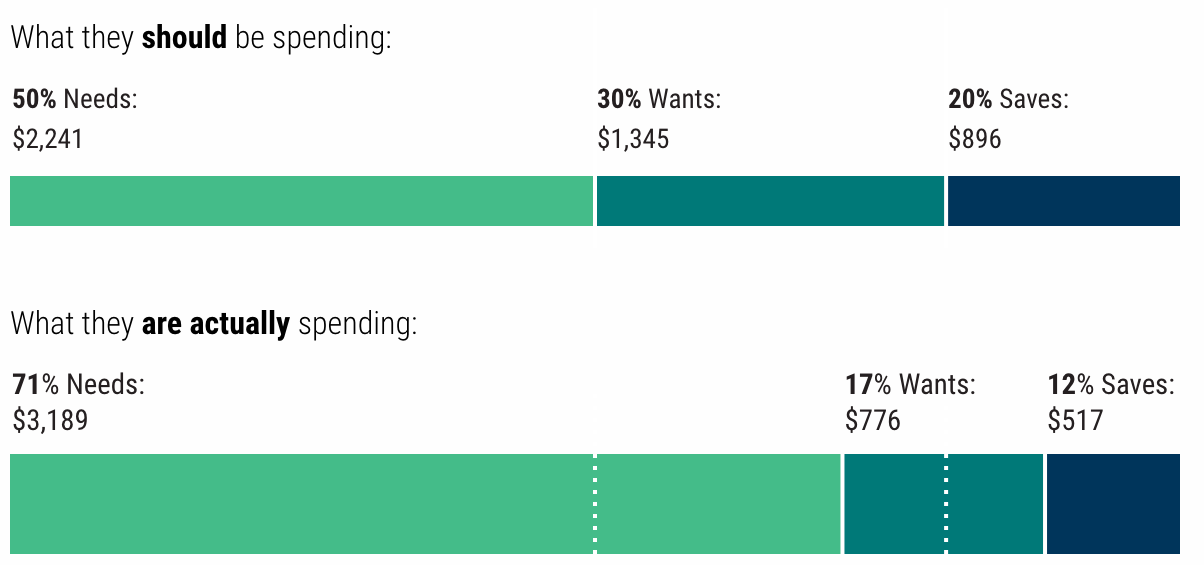

The simulation starts by explaining the 50/30/20 budgeting rule of thumb which is the idea that 50% of budget should be spent on needs, 30% on wants and 20% on savings and paying down debt.

It then has students select from one of three scenarios:

- Married couple with 2 children in Boise, Idaho

- Single adult male in Chicago, Illinois

- Single mother with one child in Cleveland, Ohio

It then compares data on how they actually spend their money (from variety of public sources) compared to how they should (if they followed the 50/30/20 budgeting rule). Here's the example of the couple with 2 children in Boise, Idaho:

Peeling back the onion a step further, it takes each of the costs that they are actually spending and shows how it breaks down into major categories.

Students then have the option to create their own scenario by choosing from one of 25 locations and a household size.

Questions:

- In your own words, explain the 50/30/20 budgeting rule of thumb.

- In the scenario that you created, which location and household size did you choose?

- Was the individual/family scenario that you chose able to follow this principle by spending 50% on their needs, 30% on their wants and 20% on savings and debt paydown?

- If not, what expense had the largest impact in making them unable to keep their necessities under 50%?

- Choose 3-4 different scenarios to find a city where it's possible to live within the 50/30/20 rule.

------------------

Like this interactive? Be sure to check out our Interactive Library here.

About the Author

Tim Ranzetta

Tim's saving habits started at seven when a neighbor with a broken hip gave him a dog walking job. Her recovery, which took almost a year, resulted in Tim getting to know the bank tellers quite well (and accumulating a savings account balance of over $300!). His recent entrepreneurial adventures have included driving a shredding truck, analyzing executive compensation packages for Fortune 500 companies and helping families make better college financing decisions. After volunteering in 2010 to create and teach a personal finance program at Eastside College Prep in East Palo Alto, Tim saw firsthand the impact of an engaging and activity-based curriculum, which inspired him to start a new non-profit, Next Gen Personal Finance.

SEARCH FOR CONTENT

Subscribe to the blog

Get Question of the Day, FinCap Friday, and the latest updates from NGPF in your inbox by subscribing today:

MOST POPULAR POSTS