Question of the Day: How many payments does the average consumer make each month?

From morning coffee to paying rent, life is full of payment transactions! How does that add up over the month?

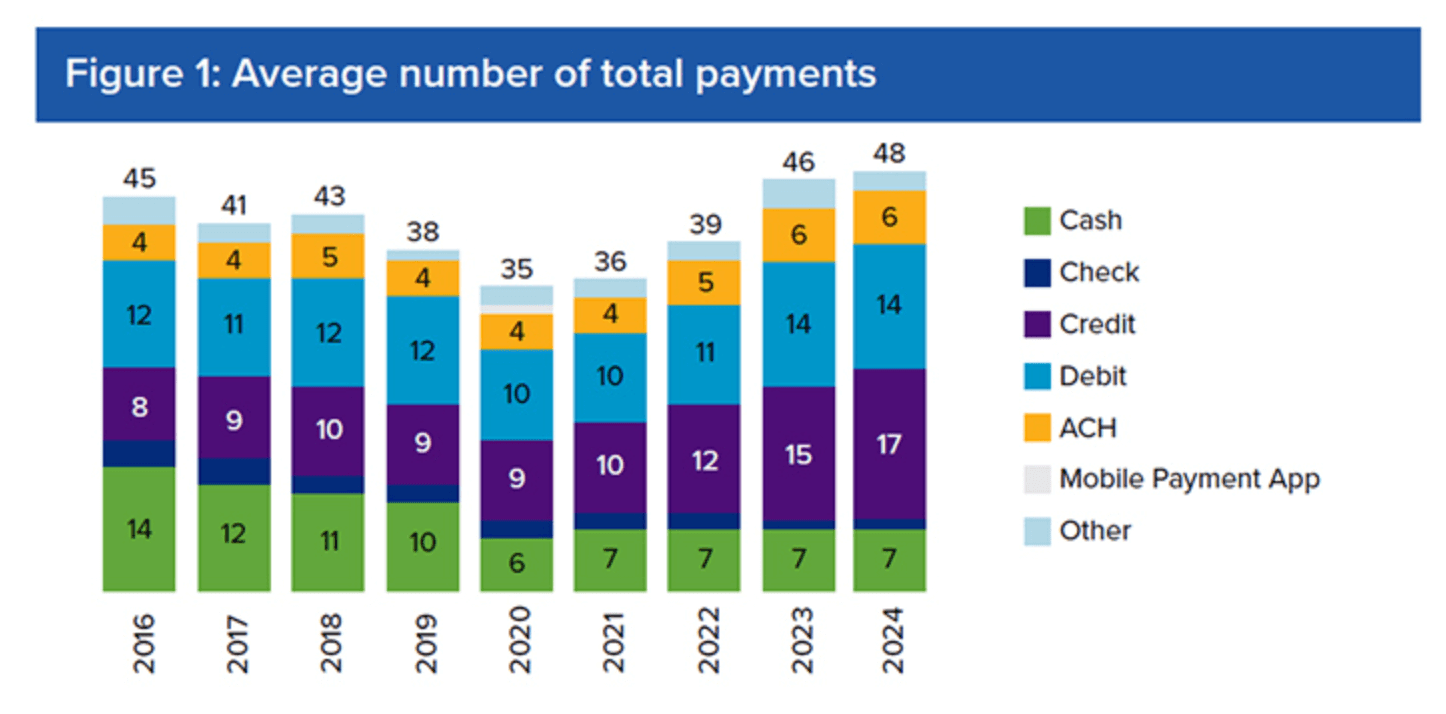

Answer: 48 transactions

Questions:

- Give 3 examples of payment transactions that might be counted in this data.

- What are the ways that you pay for things? List them from most to least frequent.

- How do you keep track of your payments?

- How do you think the way you pay for things might change as you get older?

Click here for the ready-to-go slides for this Question of the Day that you can use in your classroom.

Behind the numbers (Federal Reserve Financial Services):

"Overall, U.S. consumers made an average of 48 payments per month in 2024, continuing an upward trend that began in 2021. Increased credit card usage, remote payments and payments made with mobile devices fueled growth in the overall number of payments.

Within this evolving payment landscape, cash use remained stable. In 2024, consumers made an average of seven payments per month with cash, a number that has remained unchanged since 2020. Additionally, cash was the third-most-used payment instrument after credit and debit cards, a position it has held for the past five years."

--------------

This NGPF activity PLAY: Payment Decisions, allows students to determine which payment type to use in different scenarios.

About the Author

Kathryn Dawson

Kathryn (she/her) is excited to join the NGPF team after 9 years of experience in education as a mentor, tutor, and special education teacher. She is a graduate of Cornell University with a degree in policy analysis and management and has a master's degree in education from Brooklyn College. Kathryn is looking forward to bringing her passion for accessibility and educational justice into curriculum design at NGPF. During her free time, Kathryn loves embarking on cooking projects, walking around her Seattle neighborhood with her dog, or lounging in a hammock with a book.

SEARCH FOR CONTENT

Subscribe to the blog

Get Question of the Day, FinCap Friday, and the latest updates from NGPF in your inbox by subscribing today:

MOST POPULAR POSTS