5 Cool New Videos: Savings Tips, Payday Lending and Stock Market Winners and Losers Over the Past 20 Years

I wanted to share some cool new videos that we have come across in our travels:

- Three Psychological Tricks to Help You Save Money (TED Talks; 5 minutes); hat tip to Yanely for connecting us to Wendy; hope to have her on podcast in the future.

- Backgrounder on the Payday Lending industry (PBS NewsHour; 4 minutes); good opportunity to discuss the financial pitfalls of payday lending, it's fee structure and the role of regulation in consumer protection.

- How Kids Are Adapting To A Cashless Society (PBS NewsHour; 7 minutes); a timely topic with cities recently weighing in on retail establishments that don't accept cash.

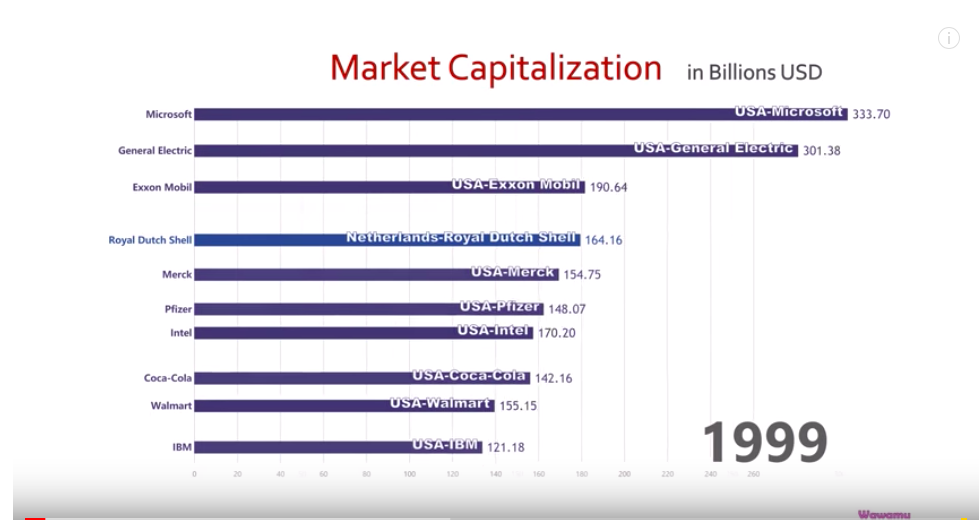

- Two videos show that how stock market winners for the overall market and for tech companies specifically have changed over time. Hat tip for Brian Page and Beth Tallman for bringing these to our attention. A few questions:

- Compare the list of companies from 1999 to 2018 from both videos.

- How many of the 1999 leaders stayed on the list 20 years later?

- What does this tell you about shifts in the overall economy?

- Does this make you more/less confident that you can pick individual stocks knowing who the future winners will be?

- For the first video, what industry seems to have seen the most growth in the past 20 years? Hint: In looking at 2018 leaders, what industry do most come from?

- How do you think these lists might look 20 years from now? How many companies will still be leaders at that time? Why?

- Compare the list of companies from 1999 to 2018 from both videos.

Stock Market leaders from 1999-2018 (4 minute video; play at 2X speed)

Tech Companies from Visual Capitalist (1 minute video; yes, a lot has changed over 23 years!):

About the Author

Tim Ranzetta

Tim's saving habits started at seven when a neighbor with a broken hip gave him a dog walking job. Her recovery, which took almost a year, resulted in Tim getting to know the bank tellers quite well (and accumulating a savings account balance of over $300!). His recent entrepreneurial adventures have included driving a shredding truck, analyzing executive compensation packages for Fortune 500 companies and helping families make better college financing decisions. After volunteering in 2010 to create and teach a personal finance program at Eastside College Prep in East Palo Alto, Tim saw firsthand the impact of an engaging and activity-based curriculum, which inspired him to start a new non-profit, Next Gen Personal Finance.

SEARCH FOR CONTENT

Subscribe to the blog

Get Question of the Day, FinCap Friday, and the latest updates from NGPF in your inbox by subscribing today:

MOST POPULAR POSTS